What You Need to Know About Insurance Authorizations

What You Need to Know About Insurance Authorizations

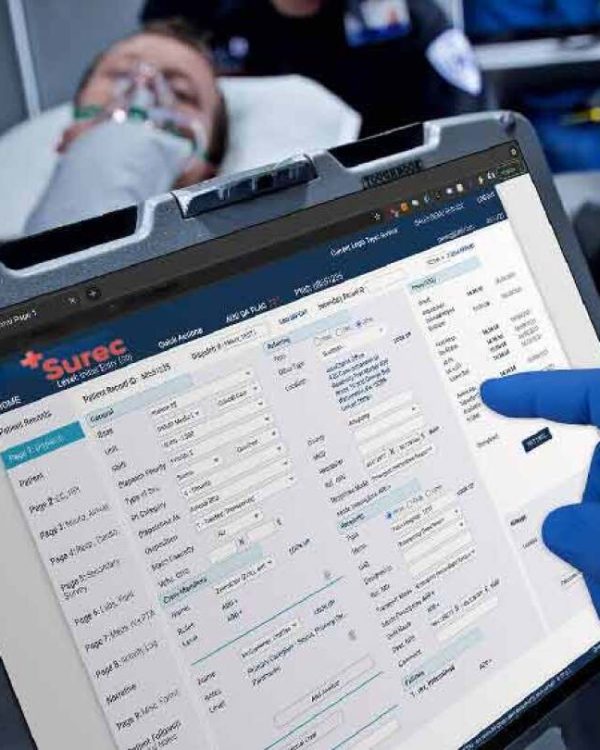

Insurance authorizations are a critical component of the healthcare billing process. They refer to the approval required by a patient’s insurance provider before certain medical services, treatments, or procedures can be performed. Without obtaining prior authorization, healthcare providers risk having the insurance company deny the claim, resulting in unpaid services. At Paramedic Billing Services, we streamline the authorization process, ensuring timely approvals so you can focus on patient care, not administrative hurdles.

Understanding the nuances of insurance authorizations is essential for healthcare providers to maintain smooth operations and prevent unnecessary delays or denials in payment.

Types of Insurance Authorizations

There are different types of insurance authorizations that providers may encounter, each depending on the service being provided and the specific insurance plan. Knowing which authorization is needed is crucial for securing timely approval.

- Pre-Authorization (Prior Authorization)

This is the most common form of insurance approval. It requires that certain services, such as surgeries or specialist visits, are pre-approved before being provided. Pre-authorizations are typically required for non-emergency, high-cost procedures or treatments. - Concurrent Review

This type of authorization occurs when ongoing medical care, such as an extended hospital stay, requires continued approval by the insurance provider. The insurer evaluates the necessity of continued care as treatment progresses. - Retrospective Authorization

Retrospective authorization is needed when services have already been provided without prior approval, often due to emergencies. In these cases, the provider must seek approval after the fact to ensure the claim is paid.

Understanding these different types helps providers and their staff navigate the complex requirements of insurance companies and avoid delays in reimbursement.

The Insurance Authorization Process

The authorization process involves multiple steps, and missing even one can lead to claim denials. At Paramedic Billing Services, we help healthcare providers follow a structured process to ensure that all authorizations are properly obtained and documented. Here’s an overview of the key steps:

- Submit the Authorization Request

The first step is submitting a request for authorization to the insurance company. This typically includes the patient’s medical records, the recommended treatment plan, and any necessary supporting documents that demonstrate the medical necessity of the procedure. - Follow Up with the Insurance Company

After submitting the request, it’s essential to follow up with the insurance company to ensure the request is being reviewed. Insurance companies often require additional information or clarification, which needs to be provided quickly to avoid delays. - Receive the Decision

Once the insurer has reviewed the request, they will either approve or deny the authorization. If denied, the provider may need to submit additional documentation or file an appeal to challenge the decision. - Document the Authorization Approval

Once authorization is granted, it’s critical to document it thoroughly and include the approval in the patient’s medical records. This ensures that the authorization is easily accessible during the billing process and can be referenced if needed.

Common Challenges with Insurance Authorizations

While insurance authorizations are necessary, they often come with challenges that can slow down the process or lead to denials. Paramedic Billing Services works proactively to minimize these hurdles by addressing common issues that arise during the authorization process.

Common challenges include:

- Incomplete or inaccurate documentation

Missing information can cause delays or denials. Ensuring all required documents are included in the initial request is vital. - Changes in insurance policies

Insurance providers frequently update their policies, making it challenging to stay current on authorization requirements. Regularly reviewing insurance policy updates helps avoid surprises. - Tight deadlines

Insurance companies often impose strict deadlines for submitting authorization requests. Missing these deadlines can result in non-payment.

Why Use Paramedic Billing Services?

At Paramedic Billing Services, we specialize in managing insurance authorizations to ensure your claims are processed smoothly and on time. Our team handles the entire authorization process, from submitting the initial request to tracking and following up with insurance providers. By entrusting us with your authorizations, you can reduce administrative burdens, avoid delays, and minimize the risk of claim denials.

Our focus is on improving the efficiency of your billing processes so you can focus on delivering high-quality care. Let us handle the complexities of insurance authorizations, ensuring that your practice is paid for the services it provides.